President Trump and the GOP Congress are running a tax scam that's a real winner for wealthy people and corporations and a real loser for everyone else. They are making empty child care promises, attacking religious liberty by doing away with the Johnson Amendment, and chipping away at public education. They're also threatening immigrant children by seeking to deny important tax benefits like the Child Tax Credit to anyone without a Social Security number—including approximately 1 million DREAMers and their families. Anti-child and anti-immigrant proposals have no place in any tax or budget debate, as People For the American Way, the Center for Law and Social Policy, the National Immigration Law Center, and more than 200 other national, state, and local leaders made clear in a November 15 letter. You can download our letter, with signers, here.

Dear Members of Congress,

President Trump’s proposed FY 2018 budget and the tax bills introduced by House and Senate Leadership are threatening to take crucial tax credits from children in immigrant families. The loss of these credits will drive children and families into poverty. These proposals include provisions taking away the Child Tax Credit (CTC) and its refundable component, the Additional Child Tax Credit (ACTC) from children without Social Security Numbers (SSNs). The House bill also threatens to deny access to the American Opportunity Tax Credit (AOTC), a critical support that helps students get the education they need to access economic opportunities.

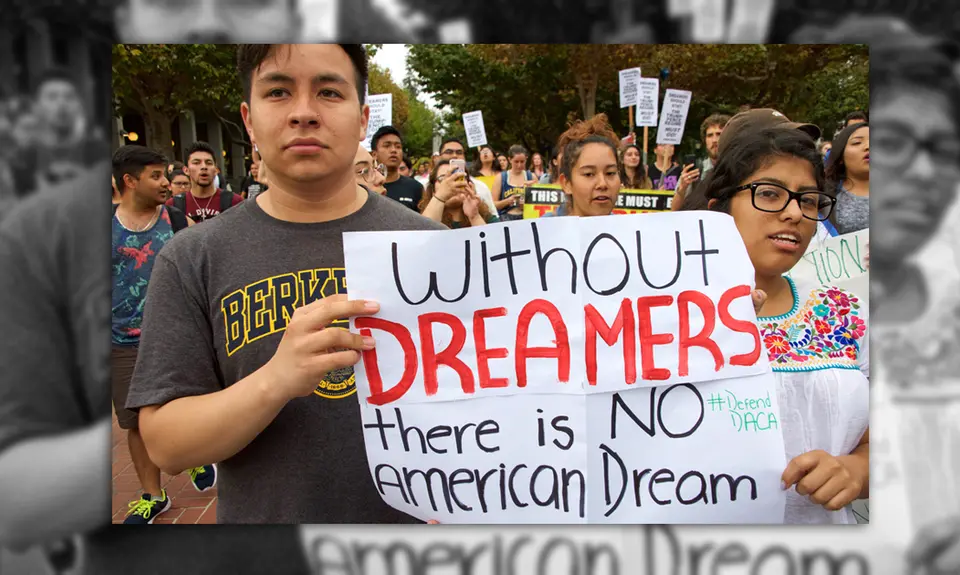

Restricting the CTC to filers using Social Security Numbers (SSNs) could impact as many as 5 million children living in mixed-status immigrant families, the majority of whom are US citizens, and up to 1 million of whom are young DREAMers. Stripping tax benefits from any children in the family will harm the families as a whole. We, the undersigned advocates for immigrants, anti-hunger advocates, anti-poverty groups, faith leaders, and advocates for diversity urge Members of Congress to oppose any proposals to deny tax credits to hardworking immigrant families and their children.

Eliminating the Child Tax Credit for children in taxpaying immigrant families will increase child poverty. The CTC is an effective antipoverty tool that played an essential role in lifting approximately 2.7 million people out of poverty in 2016, including about 1.5 million children, and mitigates poverty for millions more. The harm caused to children by denying them the CTC now will compound over time, as household income levels are correlated with cognitive development and future work opportunities. Investing in the economic security of children through access to the CTC rewards paying taxes, helps working families, benefits the economy, and invests in future generations. Any change in eligibility for child tax credits will harm only one population: children.

Attacks on tax credits for taxpayers who file with Individual Taxpayer Identification Numbers (ITINs) hurt taxpayers and local economies. In 2015, ITIN filers paid $23.6 billion in total federal taxes, including over $5.5 billion in payroll and Medicare taxes. ITIN filers also contribute to tax revenue by paying sales, gas, and property taxes. CTC dollars help grow local economies and support businesses. Every additional dollar received by low- and moderate-income families has a 1.5 to 2 times multiplier effect, in terms of its impact on the local economy and how much money is spent in communities where these families live. Investing in CTC for immigrant families enables them to invest back in their local economies.

The House tax plan would also deny ITIN filers the American Opportunity Tax Credit (AOTC), a refundable credit that makes postsecondary education more affordable. Without the training and skills needed for new career opportunities, hard-working people will struggle to get the skills and credentials to improve their own economic security and help grow the US economy.

We strongly oppose all of the anti-child and anti-immigrant proposals in President Trump’s proposed budget and the House and Senate leadership tax plans, including new restrictions on CTC and AOTC eligibility for taxpayers. We urge Congress to do the right thing and stop efforts to fund tax cuts on the backs of children and working families.