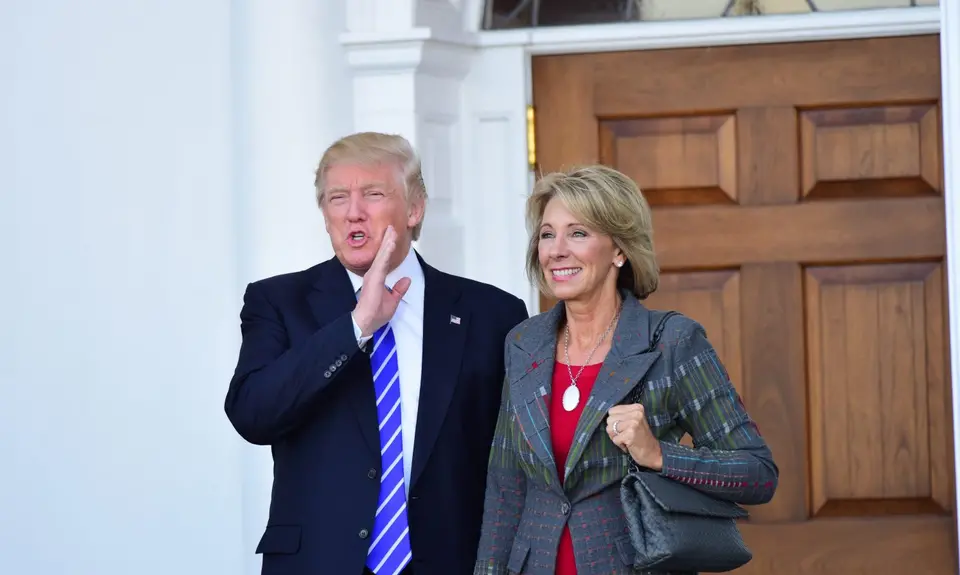

Betsy DeVos was confirmed as U.S. Secretary of Education on February 7, 2017. People For the American Way has been keeping a close eye on her since reports of her nomination first surfaced last November—with good reason. Years of PFAW coverage of the DeVos family have shown not only their unmistakable effort to divert public education funds into religious schools, but also their role as policy power players guiding the whole of the far-right agenda. DeVos' short tenure as secretary has already been marked by one civil rights controversy after another. Now the department is changing the rules for student loans, which will have a disproportionate impact on people of color. PFAW joined The Leadership Conference on Civil and Human Rights, UnidosUS, and 37 other organizations on a letter urging DeVos to keep the current rules in place that protect students from predatory practices. You can download this letter, with endnotes, here.

Dear Secretary DeVos:

On behalf of The Leadership Conference on Civil and Human Rights, a coalition charged by its diverse membership of more than 200 national organizations to promote and protect the civil and human rights of all persons in the United States, and the 39 undersigned organizations, we write to express our strong concern regarding recent changes made by the Department of Education. These include alterations to student loan servicing guidance and procurement requirements, debt collection contracting, and the delay of critical regulations. While we are concerned about the impact of these changes on all borrowers, we are especially alarmed about the impact of your actions on Black and Latino borrowers.i These actions are inconsistent with the Department of Education’s responsibility to advance higher education and serve the interests of all students, including students of color.

As it stands, the student loan servicing industry too often fails borrowers of color. While on the front end, student loans can provide opportunities for students without the financial means to attend college, repaying the loans is too frequently a struggle for borrowers of color.ii The barriers these students face are, in large part, the result of inequities in family wealth,iii race-based differences in earnings,iv and Black and Latino students’ overrepresentation in high-cost, low-quality for-profit colleges and universities.v These broader challenges are exacerbated by problems in student loan servicing systems and insufficient oversight by the Department of Education. Default and delinquency can ruin a person’s credit score and damage their credit profile, affecting their ability to acquire other wealth-building lines of credit like a mortgage or auto loan. Remedies are long overdue to address the barriers that students, especially students of color, face in achieving on-time repayment of student loans.

Unfortunately, the changes recently announced by the Department of Education would exacerbate inequalities, making the already unfair and ineffective student loan servicing system even more harmful to all students and families seeking higher education.

Rescinding Memoranda Holding Servicers Accountable for Their Track Record

On April 11, 2017, the department rescindedvi three memos that sought to reform the student loan servicing market and ensure the interests of borrowers were central to government contracts. The June 30, 2016 memo had required past performance on student loan to be the most important non-cost factor when reviewing bids during the procurement process for new servicing contracts issued once the current ones expire.vii The July 20, 2016 memo and October 17, 2016 addendum sought to ensure high-quality service for borrowers, and encouraged optimum borrower outcomes from loan servicers and customer service providers.viii

Unfortunately, several student loan servicers have a history of inadequate and sometimes illegal servicing practices. For example, the student loan servicer Navient was sued in January 2017 by the Consumer Financial Protection Bureau (CFPB) for failing borrowers at every stage of repayment, most egregiously by steering borrowers into costly forbearance rather than helping them enroll in an income-driven repayment plan. In an effort to dismiss the suit, Navient claimed they should not be expected nor are they required to act in the best interest of the consumer and that their main priority is to garner payments from borrowers. The Department of Education is accountable to students and it is the students’ interests that should be the basis for every decision, especially when the department is soliciting bids and awarding new student loan servicing contracts impacting millions of students.

Amendments to Student Loan Servicing Solicitation Guidelines

On May 19, 2017, the department issued revised federal loan servicing requirements.ix It should be industry-wide practice to provide information to students in the language that they speak most comfortably, but alarmingly, these new guidelines omitted requirements for servicers to provide communications in Spanish to borrowers who indicated that need, and also omits the requirement for servicers to provide borrowers a website in Spanish.x The revisions also no longer required the inclusion of the “Payback Playbook,” an information tool developed by the CFPB to inform borrowers of their repayment options. All of these requirements help borrowers get the information they need in their preferred language—a necessary element of any successful, responsive, and equitable servicing strategy. While the department has cancelled this solicitation for loan servicers as of August 1, 2017, moving forward it will be crucial for the department to reinstate these protections in any new solicitation on behalf of borrowers.xi

Rehiring of Debt Collection Agencies with a History of Abusive Practices

When loan servicers fail to provide quality guidance and assistance to borrowers, they struggle to repay and may face delinquency and default. Defaulted borrowers are often contacted by private collection agencies, the department’s debt collection contractors. In 2015, the department reviewed private collection agency practices and decided to no longer award new debt collection contracts to five companies that had been providing inaccurate information to borrowers.xii Four of those companies sued the department in February and, to end the litigation, the department announced it would reconsider assigning accounts to the companies.xiii Going forward, it is incumbent upon the department to ensure debt collection agencies contracted to interact with student loan borrowers experiencing severe financial hardship are held accountable and that strong consumer protections ensure borrowers are given accurate and timely information.

Slow Down of Loan Discharges and Halting of Borrower Defense Regulations

Under regulations issued in 1995,xiv borrowers defrauded by their postsecondary institutions are granted a defense to repayment, meaning they have a legal right to not repay their loans. Since January 20, 2017, however, no new students have been approved for borrower defense discharges. Reports from Mayxv and June of this year suggest that review of applications for relief from defrauded student borrowers has ground to a complete halt under the Trump administration.xvi In a July 7, 2017 letter sent in response to an inquiry from Senator Richard Durbin, the acting undersecretary of the department confirmed that the department had not approved a single borrower defense claim since January 2017.xvii

Further, the department doubled down by posting a notice on June 16 in the Federal Register indicating that the effective date of the more recent borrower defense rule, finalized on November 1, 2016, would be delayed indefinitely and that it will be renegotiating the rule.xviii The November 2016 regulation established a new federal standard and process for determining when borrowers had a defense to repayment because of their institution’s behavior and were set to go into effect July 1, 2017. The regulations also clarified the false certification discharge process for student loan borrowers without high school diplomas. In addition, the regulations ensured that students at schools that close suddenly knew their options and would receive automatic loan discharges if they did not continue their studies within three years of the school’s closure. Finally, the 2016 rule severely limited the ability of schools receiving federal student aid to evade accountability by using pre-dispute arbitration clauses and class action waivers to evade accountability (a tactic used by Corinthian and ITT Technical Institutes).xix Restoring access to the courts is an important step in allowing defrauded students to seek relief directly from the schools that mistreated them.

Discharging debt held by students who were defrauded by their institution is essential to help ensure those students avoid delinquency and default due to an inability to pay for an insufficient credential from predatory institutions. The department should end its efforts to renegotiate these regulations and implement and enforce the rule as is required by law.

Delay and Renegotiation of Gainful Employment Regulation

On October 31, 2014, the previous administration finalized regulations implementing a provision of the Higher Education Act that allows for federal aid to be used by students participating in programs which lead to “gainful employment in a recognized occupation.”xx These regulations provide greater protections for students against career education programs using aggressive and deceptive recruiting, false claims, and predatory lending practices that lead to higher student loan debt. The regulations, already in effect, are especially important to students of color who are overrepresented in these programs and who experience disproportionate harm through the abuses of many for-profit colleges. In the fall of 2014, several civil rights organizations authored a brief describing the ways in which students of color were more likely to be enrolled in high-cost, low-quality programs and calling for strong regulation.xxi

On June 16, 2017, the department posted a notice in the Federal Register indicating its intent to renegotiate these regulations.xxii On June 30, 2017, the department delayed key parts of the rule.xxiii While schools are still required to post new improved consumer disclosures as of July 1, they will not need to distribute these disclosures to students or provide a link to them in their promotional materials until July 1, 2018. This means few students will see these important disclosures. The department is also allowing all schools to appeal their ratings and will make it easier for them to do so, even though the court ruling used as a pretext to delay the rule only applied to schools that are members of the American Association of Cosmetology Schools (AACS). While these appeals are pending, the schools do not need to disclose anything to students, creating a loophole that undermines the substance of the regulation.

Rather than reopening critical regulations that protect borrowers and instead allowing for the continued exploitation of students of color, the department should focus on implementing the regulations already in place and taking additional action to protect borrowers—including limiting enrollment at poorly performing institutions until they improve, ensuring information provided to students is transparent and accurately reflects careers outcomes, and helping students avoid taking on large amounts of debt without an associated wage premium.xxiv Recent announcements by the Office of Federal Student Aid indicate that the department plans to take a different approach and reach out quietly to top officials at schools suspected of fraud.xxv The department should instead be focused on protecting the students they are obligated to serve and provide a true disincentive for schools to deceive students by enforcing regulations and conducting through assertive and transparent investigations.

Effect on Borrowers of Color

We are concerned that the above changes spell disaster for students of color who are too often exploited in consumer lending. Black and Latino students are particularly vulnerable to predatory practices in the lending space, as they come from families with significantly less wealth than White students: in 2013, the median White family held 13 times more wealth than the median Black family and 10 times more wealth than the median Latino family.xxvi Therefore, to afford rising college costs, many students of color take out as much or more debt than their White peers.xxvii Further, these students are often targeted by more expensive, lower-quality for-profit programs, where they represent 41 percent of all students enrolled.xxviii Studies have shown these programs do not provide a wage premium for graduates,xxix leaving them saddled with significant amounts of debt and no means with which to repay.

Once in the workforce, graduates of color have lower wages than their White peers, even when controlling for education level. Bureau of Labor Statistics data shows that median weekly earnings for Latino students with a Bachelor’s degree are only 83 percent of what Whites earn. For Black Bachelor’s degree holders, their weekly median earnings are only 79 percent of what Whites earn.xxx These factors compound to create an environment in which borrowers of color are left with debt but insufficient means, whether their own income or familial wealth, with which to repay.

Current repayment options for federal student loans include income-driven repayment plans—where payments are tied to income and can be as low as $0 a month—so one could assume borrowers’ payments would reflect their current ability to repay. Unfortunately, that is not the case, as the current student loan servicing market is failing students and failing to provide students with the information they need. A Demos analysis of Experian data found that in 2014, 43.7 percent of Latino borrowers and 52.6 percent of Black borrowers in repayment were in default or seriously delinquent, compared to 36.6 percent of White student debtors.xxxi Additionally, a study by the Financial Industry Regulatory Authority suggests that 41 percent of Latino, 49 percent of Black, and 32 percent of White student loan holders with payments due had been late on their student loan payment at least once over the past year.xxxii

Student loan servicers decide what repayment plan information borrowers have and they are supposed to help borrowers navigate their options. Breakdowns in servicing efficiency and efficacy directly impact the ability of borrowers to enroll in income-based repayment plans and stay current on their loans. These breakdowns also create an opening for third party debt scams that charge borrowers for enrollment in free government programs. In one survey, Black and Latino borrowers were more likely to have paid for these services than were White students.xxxiii Federal regulators have been able to take some action against these types of scams, but until students receive complete and accurate information from their servicers, there will be a market for third parties to charge for this information.xxxiv Therefore, strong regulations regarding student loan servicers and requirements outlining the quality of service that borrowers must receive under the law are essential to help ensure borrowers can remain in good standing.

We call on you to implement and enforce these existing final regulations to protect students from predatory practices in both higher education and student loan servicing. We also urge you to hold student loan servicers and debt collectors accountable for their practices and to require any future contracts awarded include strong consumer protections for borrowers. Even with these protections, disparate outcomes for borrowers of color remain, underscoring the need for the department to, at the very least, keep them in place and explore further actions to protect students.

If you have any questions or need additional information, please contact Liz King, director of education policy at The Leadership Conference, at [email protected] or (202) 466-0087 or Lorén Trull, senior policy advisor, education policy at UnidosUS, at [email protected] or (202)776-1791.

Sincerely,

The Leadership Conference on Civil and Human Rights

UnidosUS

American Association of University Women (AAUW)

American Civil Liberties Union

American Federation of State, County and Municipal Employees (AFSCME)

American Federation of Teachers

American-Arab Anti-Discrimination Committee

Americans for Financial Reform

Augustus F. Hawkins Foundation

Center for Law and Social Policy (CLASP)

Center for Responsible Lending

Consumer Action

Consumer Federation of America

Demos

Disability Rights Education & Defense Fund

Equal Justice Works

Generation Progress

Higher Ed, Not Debt

Hispanic Association of Colleges and Universities (HACU)

Lawyers’ Committee for Civil Rights Under Law

League of United Latin American Citizens

Maryland Consumer Rights Coalition

NAACP

The NAACP Legal Defense and Educational Fund, Inc.

National Alliance for Partnerships in Equity (NAPE)

The National Association for Bilingual Education (NABE)

National Association of Consumer Bankruptcy Attorneys (NACBA)

National Consumer Law Center (on behalf of its low-income clients)

National Urban League

National Women’s Law Center

New York Legal Assistance Group (NYLAG)

One Wisconsin Now

People For the American Way

PHENOM (Public Higher Education Network of Massachusetts)

Progress Virginia Education Fund

Public Citizen

Southeast Asia Resource Action Center

Student Debt Crisis

TASH

Young Invincibles