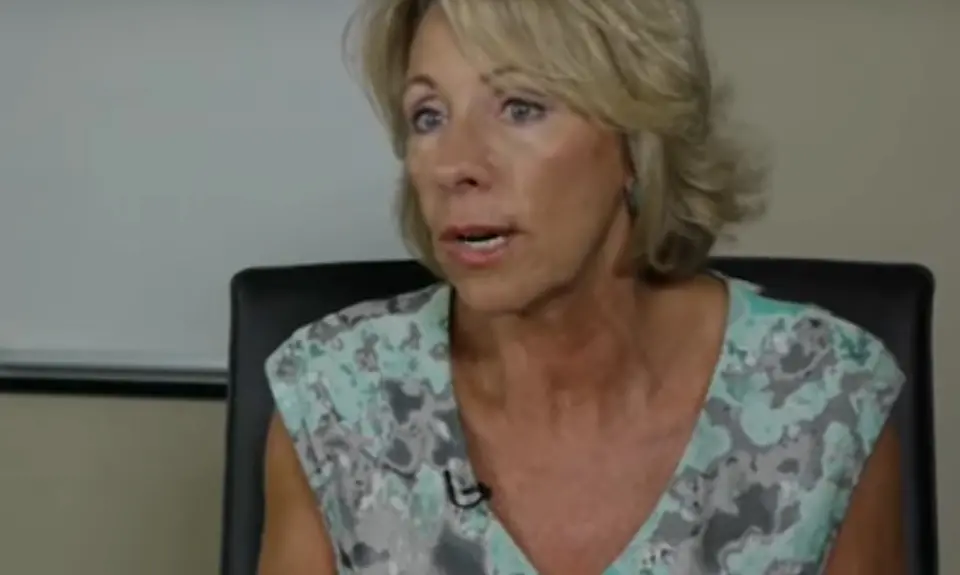

A New York Times profile of Donald Trump’s nominee for secretary of education, Betsy DeVos, introduces her “as a philanthropist, activist and Republican fund-raiser,” who has spent 30 years, “push[ing] to give families taxpayer money in the form of vouchers to attend private and parochial schools, press[ing] to expand publicly funded but privately run charter schools, and try[ing] to strip teacher unions of their influence.”

Unmentioned in the profile is that she has attempted to personally profit from the policy changes she has pursued. Financial disclosures made during the failed 2006 Michigan gubernatorial campaign of her husband, Dick DeVos, reveal that the couple owned shares of K12 Inc., a company whose core business is the management of public for-profit online charter schools. While the financial disclosure document specifically mentions the DeVos’ joint ownership of assets, it does not reveal the quantity, type or value of shares the couple held in the company.

DeVos’ involvement in K12 Inc. is particularly troubling because of the myriad of controversies that have surrounded the company over the past few years. I previously wrote about the company’s ties to Jeb Bush for the New York Observer in 2015. (The company responded in a blog post that has mysteriously disappeared from its site, but can be viewed in the Internet Archive.)

In 2011, The New York Times published a scathing piece on K12 Inc., which began by chronicling a Pennsylvania school managed by the company:

By almost every educational measure, the Agora Cyber Charter School is failing.

Nearly 60 percent of its students are behind grade level in math. Nearly 50 percent trail in reading. A third do not graduate on time. And hundreds of children, from kindergartners to seniors, withdraw within months after they enroll.

By Wall Street standards, though, Agora is a remarkable success that has helped enrich K12 Inc., the publicly traded company that manages the school. And the entire enterprise is paid for by taxpayers.

More recently, on November 3, Education Week wrote that “for five years in a row, the Hoosier Academies Virtual School had been failing.” The school, which Education Week notes is run by K12 Inc., “had been assigned an 'F' grade from the state of Indiana every year it had been open except its first, when it had garnered a 'C.'"

Education Week went on to note:

Despite more than a decade of state investigations, news media reports, and research that have documented startling failures and gross mismanagement in full-time online schools, the sector—dominated by two for-profit companies—continues to expand, spreading into new states and enrolling more students.

Betsy DeVos was and possibly is personally invested in this failure and was at the end of a funnel that took tax dollars dedicated to public schools and transferred them to Wall Street.

In her confirmation hearing, she should not only be questioned about her investment in K12 Inc. and her view on its track record, she should also be asked if she is still invested in the company. If she is, she should not be confirmed unless she divests. The conflict of interest that would exist should she continue to own shares in the K12 Inc. is made clear in the company’s annual report, which notes: “The public schools we contract with are financed with government funding from federal, state and local taxpayers. Our business is primarily dependent upon those funds.”

In the same document, the company lays out the influence federal education policy has over its profits: [Emphasis added]

As the provision of online K-12 public education matures, novel issues may arise that could lead to the enactment of new laws or regulations similar to, or in addition to, laws or regulations applicable to other areas of education and education at different levels. For example, for-profit education companies that own and operate post-secondary colleges depend in significant respect on student loans provided by the federal government to cover tuition expenses, and federal laws prohibit incentive compensation for success in securing enrollments or financial aid to any person engaged in student recruiting or admission activities. In contrast, while students in virtual or blended public K-12 schools are entitled to a free public education with no federal or state loans necessary for tuition, laws could be enacted that make for-profit management companies serving such schools subject to similar or other restrictions.

A secretary of education directly profiting by enacting policies that would further enable the funneling of money from taxpayers to a company in which she is a shareholder should be unacceptable to all Americans, regardless of their political beliefs.